08 Sep How To Calculate Cost of Goods Sold COGS

Contents:

But, COGS doesn’t include indirect costs like overhead, utilities and marketing costs. Calculating Cogs can be complex for any firm but the more manufacturing you do, the more complex it gets. If you are a merchant, inventory is the cost of the merchandise you have ready to sell to customers. If you are a manufacturer or producer, it includes the total cost of raw materials, work in process, finished goods, and supplies used in making the goods. It can also include shipping of parts, freight-in, storage, and factory overhead used to support production directly. The calculation includes any materials and direct labor expenses that go into production.

If COGS is not listed on the income statement, no deduction can be applied for those costs. COGS is an essential part of your company’s profit and loss statements, one of the most crucial financial documents for any growing business. Profit and loss statements, which are also called income statements, list your revenue and expenses to calculate your net profit. Once you download it, you can edit the cells and it’ll do the calculations for you.

What is cost of goods sold?

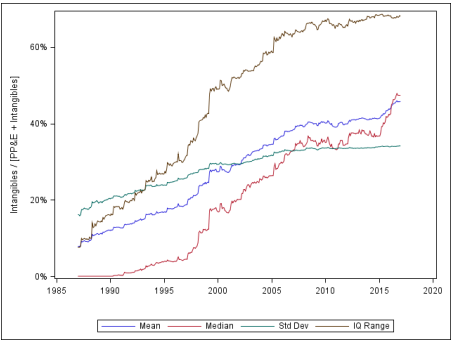

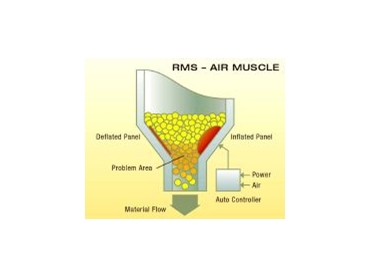

Initial and ending inventory should tally, so if you are claiming tax deductions for Cogs, you need to explain any difference on your tax return. Many companies now use technology to keep a daily or real-time eye on their Cogs. This can help you see quickly if there’s a problem and where it stems from. For example, if you are turning over $1 million a year, the difference between 60% and 61% margin is $10,000 less profit.

- As a result, you can make better decisions, especially those more likely to impact your business positively.

- So, you can find your gross profit by subtracting that number from your revenue.

- COGS includes all direct costs incurred to create the products a company offers.

- Understanding how to find cost of goods sold offers an entrepreneur an estimate of how much it will cost them to procure the material they want to sell.

- So, if a company paid $5 per unit a year ago and it pays $10 per unit now, each time it makes a sale, COGS per unit is said to be $10 until all of it’s more recently purchased units are sold.

The sales manager will calculate this ratio once a month in most cases. This ratio also shows if a company is in a good financial state or not. For example, airlines and hotels are primarily providers of services such as transport and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods. Both of these industries can list COGS on their income statements and claim them for tax purposes. A business needs to know its cost of goods sold to complete an income statement to show how it’s calculated its gross profit.

It’s important when evaluating your CoGS performance and using ratio analysis that you keep in mind the gross profit of every item, rather than trying to “manage by the percentages”. Rolling dough, cutting noodles, and prepping sauces and toppings are a lot more labour intensive than a restaurant that does not transform the raw product as much. Grilled steaks and steamed seafood, for example, don’t require much beyond proper seasoning, cooking, and storage/handling. A restaurant can be profitable with a 40% food cost, as much as a restaurant with 20% food cost can be losing money.

How to Calculate Your Cost of Goods Sold (CoGS)

On the income statement, the cost of goods sold line item is the first expense following revenue (i.e. the “top line”). By documenting expenses during the production process, a business will be able to file for deductions that can reduce its tax burden. Ending inventory costs are usually determined by taking a physical inventory of products or by estimating. The cost of goods sold is how much it costs the business to produce the items it sells. The calculation of the cost of goods sold is focused on the value of your business’s inventory. In this case, the total cost of goods sold for the year would be $110,000.

BYRNA TECHNOLOGIES REPORTS FIRST QUARTER 2023 … – StreetInsider.com

BYRNA TECHNOLOGIES REPORTS FIRST QUARTER 2023 ….

Posted: Fri, 14 Apr 2023 12:06:10 GMT [source]

In the US, Cogs are tax-deductible for any product you manufacture yourself or buy with intent to resell – so includes manufacturers, wholesalers and retailers. Any that provide services – such as doctors, lawyers, and carpenters – cannot claim the Cogs deduction unless you also sell or charge for the materials and supplies in your business. But there are different ways of accounting for each cost within it and which method you use can significantly impact your gross profit and tax liability. To get more info on how to build your own report, check out our page on how to prepare an income statement. If you don’t just sell goods but also assemble raw materials to create goods, your inventory will include all the building blocks that make up your final product.

Understanding how to find cost of goods sold offers an entrepreneur an estimate of how much it will cost them to procure the material they want to sell. As a result, it forms a significant component of their financial picture. Getting the calculation right is the first step in doing so – so let’s take a look below and see how the sales manager deals with the ratio. Here, we’ll cover what cost of goods is, how to calculate cost of goods, why cost of goods is important and some examples and use cases for winning product pricing strategies.

Tax attorney or CPA: Which does your business need?

While the cost of goods sold focuses on cost, the metric is calculated in a roundabout way. In other words, the formula focuses on the timeframe, rather than expenses. Note that neither of these calculations includes any costs for direct labor or other indirect costs.

Calculating the cost of goods sold gives a business insight into its performance and helps calculate profit. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence.

Besides that, chart of accounts example in the service industry can also use COGS in the form of cost of revenue. Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, professional dancers, etc. Even though all of these industries have business expenses and normally spend money to provide their services, they do not list COGS. Instead, they have what is called “cost of services,” which does not count towards a COGS deduction. The special identification method uses the specific cost of each unit of merchandise to calculate the ending inventory and COGS for each period.

The averaging method for calculating COGS is a method that doesn’t consider the specific cost of individual units. It doesn’t matter what was purchased when or how a company’s inventory costs fluctuate. Cost of goods sold is a company’s direct cost of inventory sold during a particular period.

What does cost of goods sold include?

Service-based businesses might refer to cost of goods sold as cost of sales or cost of revenues. Make sure to run the equation frequently to ensure your business is comfortably in the black or, if not, show you what changes you need to make to boost your profitability. To calculate the cost of goods sold for restaurants, you need to know how to take inventory.

- Understanding Cogs makes it easier to identify cost-saving measures that can boost profits.

- The process and form for calculating the cost of goods sold and including it on your business tax return are different for different types of businesses.

- Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content.

- For instance, the salary of a production supervisor can be part of COGS since the line of work is directly related to the production of goods.

- The store’s owners could use COGS to determine their total cost of inventory sold over the course of the year – a key number in determining their overall profitability for the year.

- Knowing how to calculate COGS can help you determine the correct product price, detect growth opportunities, and manage your taxes.

COGS, sometimes called “cost of sales,” is reported on a company’s income statement, right beneath the revenue line. An income statement is one of the four primary financial statements. It may go by other names, including the profit and loss statement or the statement of earnings. If your prices are lower than your competitors’, you will lose money since you have a low-profit margin. As a result, learning how to calculate COGS indirectly assists you in selling your goods at the correct price, resulting in increased sales and profit. All of your expenses and revenues must be listed on your balance sheet.

COGS vs Expenses

By contrast, fixed https://1investing.in/ such as managerial salaries, rent, and utilities are not included in COGS. Inventory is a particularly important component of COGS, and accounting rules permit several different approaches for how to include it in the calculation. The cost of goods sold applies only to businesses that sell products.

The retail method of accounting is an inventory technique used to estimate the value of ending inventory without having to take a physical count. Businesses with large volumes of inventory, like grocery stores, use the retail method because it’s quick and affordable to perform, unlike a physical count. Manufacturers add up all the costs on their product’s journey to the customer. You can choose one of multiple cost-of-sales formulas depending on whether you’re a service business, a retailer, or a manufacturer. To find cost of goods sold, a company must find the value of its inventory at the beginning of the year, which is really the value of inventory at the end of the previous year.

Assessor: property valuations on the way – Rio Blanco Herald Times

Assessor: property valuations on the way.

Posted: Fri, 14 Apr 2023 07:59:07 GMT [source]

The average cost of goods sold in the restaurant industry varies, but the cost of goods sold percentage is between 28% and 32% of revenue. Because a COGS calculation has so many moving parts, it can be prone to errors and subject to manipulation. An incorrect COGS calculation can obscure the true results of a business’ operations.

Learn with ETMarkets: Funds from operations (FFO), an important metric to analyse REITs – The Economic Times

Learn with ETMarkets: Funds from operations (FFO), an important metric to analyse REITs.

Posted: Fri, 14 Apr 2023 10:28:00 GMT [source]

Under FIFO, the business assumes the earliest goods bought or manufactured are sold first. When prices are rising, a company using the FIFO method will sell its least expensive products first, which translates to a lower cog compared to LIFO. Companies can choose from several accounting methods to decide the cost of each item in Cogs, and the method they choose can significantly impact Cogs, profitability and tax liability. Methods include first in first out ; last in first out ; weighted average; and special identification. Fast-moving businesses such as shops and cafés can even use analyze Cogs alongside sales figures per item daily. This shows which items are most popular and profitable now, or at different times of the week, month or year.

Here’s how you can effectively protect your business by selecting the correct tax professional for the job. You don’t always need to have a certificate of good standing, but this document helps to establish your company as a legitimate venture and legally authorized to conduct business. The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

Sorry, the comment form is closed at this time.